|

The Seraf Method to Valuing Startups: Valuation Look-Up Table |

|||

|

|

|||

|

|

For the final step of the Seraf Method

for valuing early stage companies, we bring it all together

and apply our adjustments to a valuation starting point. As the Berkus, Payne and Risk Factor Methods illustrate, you have to

start somewhere. But, in our view, an approach based on picking an arbitrary

one-size-fits-all number does not drive a good enough result. To find a

reasonable starting point, you have to take into

account historical market norms and the size of your particular deal. Market

statistics can help with that. Thinking of it in terms of percentage

ownership is a good yardstick. In our experience, different size rounds tend

to be associated with different ownership percentages. |

||

|

When you

look at the tens of thousands of early stage deals

which were financed each year over the last few decades, in the vast majority

of initial rounds (i.e. “professional” first rounds, not informal friends

& family rounds), investors ended up acquiring between 10% and 40% of the

company on a post-money basis. And when you remove outliers and special

circumstances, the reality is that virtually all mainstream deals end up with

investors acquiring something in the range of 15-30% of the company as a result of the round. In our

experience, where in that range of percentage ownership a given deal starts

out depends in very large part on factors which tie back in one way or

another to future financing risk - how much more money will have to be raised

in future rounds. For example: if the company is raising a small amount of

money, it won’t get very far on this money, and will definitely

need to go back out into the market and raise more money fairly

quickly. In that scenario, investors are going to want a valuation which

results in ownership towards the 30% end of the prevailing range because they

know there is a risk that the money may not come, and even if it does come,

the terms may not be attractive enough to protect from economic dilution.

|

|||

|

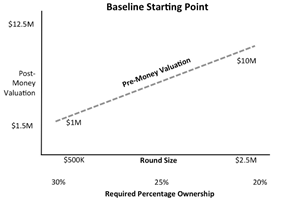

Envisioned

as a sliding scale, prevailing ownerships and valuations would look like the

following, with round size on the horizontal axis, post-money on the vertical

axis, and a real-world pre-money valuation along the diagonal scale: As you

can see from the above chart, the valuation line is not a 45

degree angle. It is flattened out a bit because there is a sliding

scale of percentage ownership. With the smaller round sizes, the percentage

ownership tends to be greater to reflect real world realities and perceived

risks. |

|

||

|

As the

company contemplates larger round sizes, the company has more resources to

apply to growth, so risk goes down and the effective percentage ownership

required also goes down. (It also has more investor interest to work with to

help fill that larger round, which helps prop up the valuation.) By using

this type of sliding scale as your starting point, you are adjusting for

market realities and prevailing norms from the many deals which get done each

year. This look-up table is designed to provide a pre-adjustment

starting point for the core 20%-25% band where most of the mainstream deals

are going to branch out from, and it assumes some of the most common early stage round sizes. However, as you adjust away from

the starting point using your data and responses from the first three

worksheets, the adjustments you make to your percentages should allow you to

cover the entire spectrum of deals that have workable founder and investor

economics. Since no deal is perfect, and all have some strengths and some weaknesses, the expectation is that many of the worksheet adjustments will cancel each other out. In fact, if you find the adjustments are all trending predominantly in one direction, and you are moving toward the extremes of the 10-40% range, that should be a major red flag. In those kinds of deals, investors should proceed with some real caution, and perhaps consider doing some additional diligence. Investors at those extremes may either be seriously overpaying for something that just is not as good as it seems, or may be entering a deal with a beaten-down team that will not be retaining enough ownership to be motivated when the going gets tough. |

|||

|

|

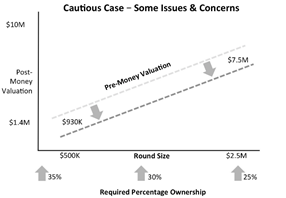

To

utilize the Valuation Look-Up Table and obtain your final valuation adjustment,

the spreadsheet carries forward your net adjustment from the first three worksheets and applies them to the Valuation Look-Up

Table. For example, if you found a company that looked really

good, the first three worksheets might net out to an adjustment

downward of half a percentage point in the amount investors feel they need to

own, with a resulting increase in the valuation investors are willing to pay.

Here is an example of that: |

||

|

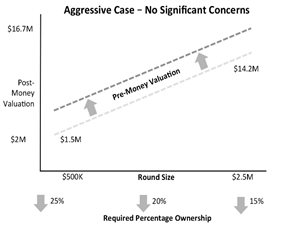

By

contrast, if you found an example of a company that raised a few more

concerns, the first three worksheets might total out to a half a percentage

point increase in the amount you’d need to own, with the resulting decrease

in valuation investors would be willing to pay. Here is an example of what

that looks like: |

|

||

|

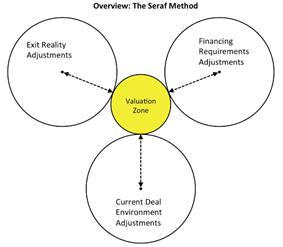

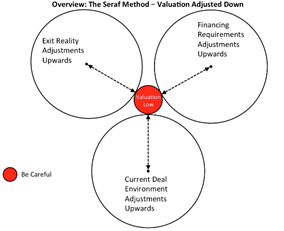

To

visualize it in terms of the original circles diagram, here is the starting

point: |

|||

|

|

By

contrast, here is a deal where you feel less good about the risk level and

decide you must adjust the required percentage ownership up on your worksheets:

|

||

|

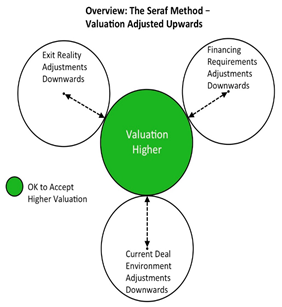

And

finally, here is a visualization of a deal where the perceived risk level is low and you feel it is acceptable to pay a higher

valuation: |

|

||

|

|

|

||

|

How to Combine the Worksheets: The Seraf

Method |

|||

|

Using the

worksheets is fairly simple. Once you have done some

basic diligence about the opportunity and are comfortable you are dealing

with a solid team, you download a copy of the Worksheet and Look-Up Table package that comprises the Seraf Method and simply work through the

drop-downs on each worksheet tab in whatever order you like and the

spreadsheet carries your adjustment factor forward to the Valuation Look-Up

Table on the fourth tab. So, for

example, Worksheet One might

result in a +0.25 percentage point increase, Worksheet Two might be +0.5 and Worksheet Three might be -0.25, resulting in a total

adjustment of percentage required at +0.5. The spreadsheet carries that

combined adjustment forward to tab four, the Valuation Look-Up Table, and adds the adjustment in to get the new

“curve,” and you look up your round size in the resulting table to find

the suggested pre-money valuation. Investing

at the right valuation is vitally important for both the entrepreneur and the

investor. If you come in at too low of a valuation the founder economics and

incentives can be destroyed. And if you come in at too high a valuation, you

may have difficulty filling the round or sustaining the post-money valuation.

And even if the company does survive, your returns will be far lower than

they should be for the risk and illiquidity undertaken. As you

can see from these worksheets, there are many different concepts involved in

arriving at a good risk-adjusted valuation - the exit realities, the

financing plan and the circumstances around the deal

itself. We have tried to put in the effort to boil our learning and

experience down into a simple tool that will allow you to make sophisticated

adjustments more easily. By working through the Seraf

Method you should have a very quick, organized and, most importantly, realistic and reliable method for coming up with a

valuation that properly captures your deal’s true value. |

|||

|

How do you handle the valuation discussion with

the entrepreneur? |

|||

|

This can

be a tricky discussion, but it helps if you start with the right mindset: · Have some humility and respect for the

entrepreneur and don’t approach it with a superior “I hold all the money and

all the cards” attitude. · Have some empathy and recognize that this is a

stressful situation for them to be in and an area where they might have much

less comfort or working knowledge than you do. · Treat it like you are trying to form a

partnership of equals that is fair to both sides and will work for the long

term good of the company. · Think of it more as an opportunity to educate

than to negotiate. If you

have that mindset, you are going to go a long way toward being successful

right from the start. You can begin your conversation by talking about shared

goals: getting a good round done quickly that is fair to both sides and allow

them to get back to running the business. Once you

establish that shared goal, you can talk about what you think it will take to

bring the investors in, and why you think that. This is your chance to

educate. It is not about beating an entrepreneur down so much as: · Helping them see the deal through the eyes of an investor · Helping them understand the implications of post-money valuation in terms of staging

capital and getting ahead of

yourself on the valuation curve · Sharing a waterfall analysis model which

illustrates the economic impact of valuation changes. In a

typical deal, a relatively small change in valuation might have a big impact

on investor appetite, but a much smaller impact on the entrepreneur’s

outcome. For example, in this model the

difference between a $3.6M pre-money and a $4M pre-money works out to about a

5% difference in outcome for the founders, using reasonable assumptions. If we are

still far apart on price, can’t you just fix it with deal terms? When you

still cannot bridge that gap, you may be tempted to try and compensate for

not getting the valuation you want by changing other terms in the deal. My

advice is to resist that temptation and tread very carefully here. With early stage term sheets, your goal, as much as possible,

should be to keep the terms as vanilla as you can. Any funky terms you help

yourself to will inevitably end up either being friction which hampers bringing

later money in, or terms insisted on by later much bigger rounds, or both. In

other words, by trying to help yourself a little bit, you can actually end up hurting yourself a lot. The one

exception to this might be with special business terms designed to

address very specific business risks. For example, if you fear a product will

not ship on time or revenue targets may not be hit, you can address that

concern with incentive compensation for the team, or other kinds of

carrot/stick tools such as operating or governance

covenants the board can administer. That kind of term makes good sense and is

specific to the business risks in a way that, say, helping yourself to a 2X

liquidation preference wouldn’t be. Incentivizing

management is totally legitimate and understandable to later investors if it

is even visible or an issue at all. By contrast, an off

market term like a multiple liquidation preference would be a disaster

for your deal long term. Options in particular can be a very powerful tool for use in this

context. Granting options to

the management team as part of a deal can be a very powerful way of both

managing their dilution concerns, and also

incentivizing their future performance. Options can also be used as a crude

way of creating an adjustable purchase price for situations where the revenue

path may vary widely. For example, we have done deals where a large special

pool is created where management would vest grants if certain sales targets

were hit. It worked very well as a simple mechanism for bridging a gap where

we wanted to pay a lower valuation for fear the revenue forecast would not be

hit, and management wanted a higher valuation because they believed in their

huge forecast. The way the mechanism worked, if management hit the targets,

they would vest big option grants which would have the result of raising the

effective deal valuation, whereas if they did not, the lower valuation would

remain. Valuation

discussions are hard, and they can be very fraught with emotion. But with the

right attitude, some listening and educational skills, the right tools, and a

little creativity, you can work your way through this process and forge not

only a great deal for all involved, but also a great relationship with your

new partner, the CEO. |

|||

|

Have you run into situations over the years with

poorly valued companies? |

|||

|

I might

not have made every dumb investor mistake in the book, but I’ve certainly

made a few. Three examples where I wish I had thought twice come to mind. Investing in a hot deal with a large pre-money

valuation: This might be the most

common mistake early stage investors make. You are

introduced to a rock star entrepreneur at a Demo Day event. She just finished

a great pitch to a huge live audience and everyone

wants in on the deal. Investor demand means the round will be oversubscribed.

So guess what? The deal ends up being overpriced. In

situations like this, it’s not unusual for the company’s valuation to be 2X

or 3X what it would be in normal circumstances. Even if the company does well

and has a nice exit, your return probably won’t be worth the risk you took. Investing in an uncapped convertible note: One of the very first investments I made was in

a young entrepreneur in Boston. I liked him a lot and thought the

product idea was solid. He was totally broke

and was trying to raise a tiny round on the simplest and cheapest possible

terms. I wanted to help him out. Since I was new to the angel investing

world, I didn’t fully understand the ramifications of investing in an

uncapped convertible note. Shortly after I made the investment, the

entrepreneur moved his company to San Francisco and raised a small amount of

money at a $20M pre-money valuation. My note converted to stock at that

valuation. Ultimately, the company was acquired, and I doubled my money. Not

a bad return on my investment, but if I had insisted on a reasonable cap to

the note (say $4M), my return would have been 10X, not 2X! This

third example might be a little ironic in an article about valuation

disciplines, but one of the biggest mistakes I ever made

or any angel can make, is passing on a great entrepreneur because the

valuation was a bit high: Ham likes to remind me of this mistake every

once in a while just to get my goat! A small group of Launchpad members

decided to invest in a medical device company. It was a very early stage company founded by a proven entrepreneur.

Given the stage of the company, I thought the valuation was about 25% too

high. So I took a pass on the investment. Fast

forward to a few years later and the company is doing incredibly well. They

are on track for a grand slam exit. I sure wish I hadn’t passed on that one.

If I had understood the concepts underlying the Seraf

Method better, I would have made all the downward adjustments to the sliders

and had the perspective to recognize that valuation for what it was: a good

deal! |

|||