Welcome to Campus Angels Network Private Limited !

At Campus Angels Network, we empower startups by providing funding of up to ₹200 lakh, supporting innovative ideas with the potential to transform the startup ecosystem. Our extensive network of Angel investors includes successful entrepreneurs, seasoned business professionals, domain experts, technocrats, and public angels, all committed to driving the growth of early-stage ventures.

We partner with leading university incubators and accelerators to identify deep-tech startups that have achieved product validation and have early paying customers. Our focus is on startups seeking funds for go-to-market validation, ensuring they are ready to scale their solutions to meet significant market needs.

To further support our startups, we offer them the opportunity to enroll in prestigious programs like those offered by the Gopalakrishnan Deshpande Center for Innovation and Entrepreneurship and Stanford Seed. Participation in these programs is optional, providing our startups with the flexibility to choose the resources that best fit their needs.

As a member of Campus Angels Network, you gain access to high-quality deal flow, invaluable networking opportunities, and insights from industry experts. Whether you’re a startup seeking funding or an investor eager to support groundbreaking innovations, join us in shaping the future of startups.

To learn more Connect us >>>

About Campus Angels

Join us to fund innovative ideas and shape India's startup ecosystem

Who We Are

Campus Angels Network Private Limited is a collective of seasoned investors, successful entrepreneurs, and industry experts, all united by a shared passion for nurturing the next generation of innovative startups. With deep-rooted experience in the startup ecosystem, our team is committed to empowering entrepreneurs to realize their full potential and achieve their business aspirations.

our vision

To be the most preferred early stage angel network in India for funding, mentoring and nurturing startups incubated at university campuses.

our mission

To support innovative and deep technology startups and help them grow.

To ensure high standards of business ethics and corporate governance.

To maximize growth, achieve national pre-eminence and maximize return to stake holders wealth.

Why Us?

Invest In Innovation

Expertise

Our team has extensive expertise in the startup ecosystem and is dedicated to helping entrepreneurs achieve their goals.

Leadership team record

We have a proven track record of supporting innovative startups and helping them achieve their goals.

Network

We have a strong network of partners and investors who can provide startups with the resources they need to succeed.

Market Access

With strong network of partners, we will provide startups support to acquire customers.

Our Team

Our team consists of experienced professionals from the industry and academia with extensive knowledge and expertise in the startup ecosystem.

Our team members have successfully incubated and accelerated several startups across multiple domains. They bring a wealth of knowledge, experience, and expertise to the table, providing unparalleled guidance and support to our members and entrepreneurs.

We believe that our team’s diverse backgrounds, expertise, and network make us the ideal partner for startups.

Founders

Advisory Board

Individual Members

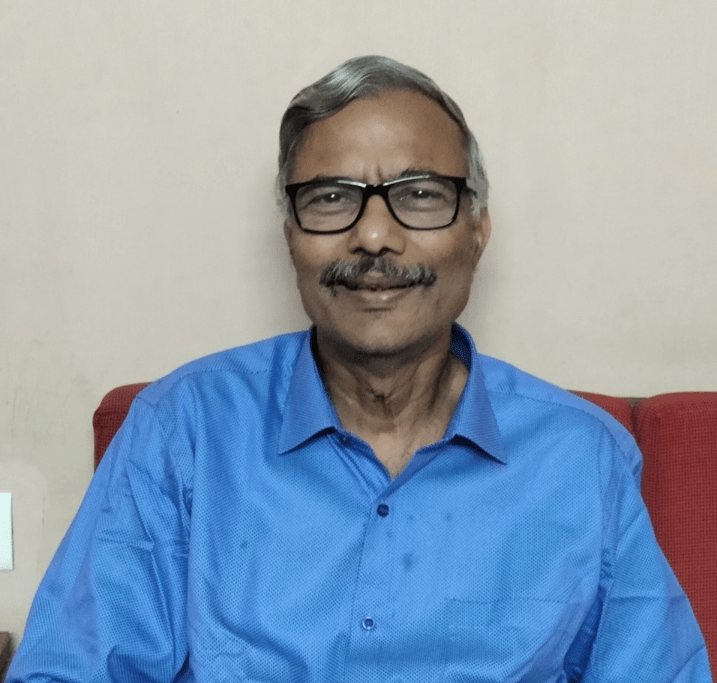

Ananth Pharshy

Principal

GPFA Council

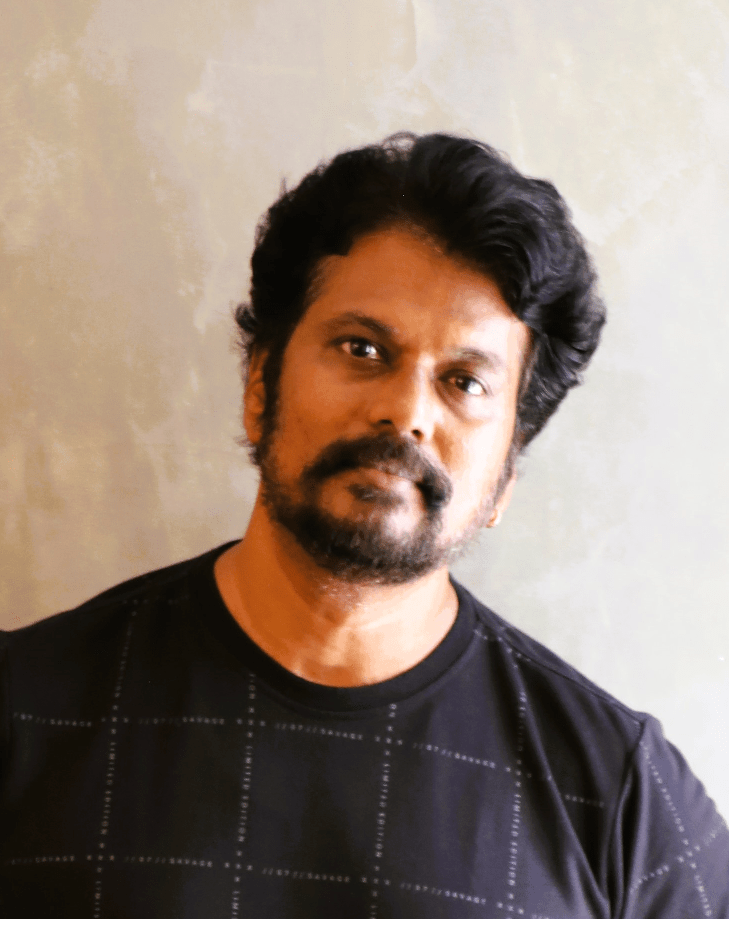

Francis Mohanraj Pandian

Managing Director

Harrington Hotels Private Limited

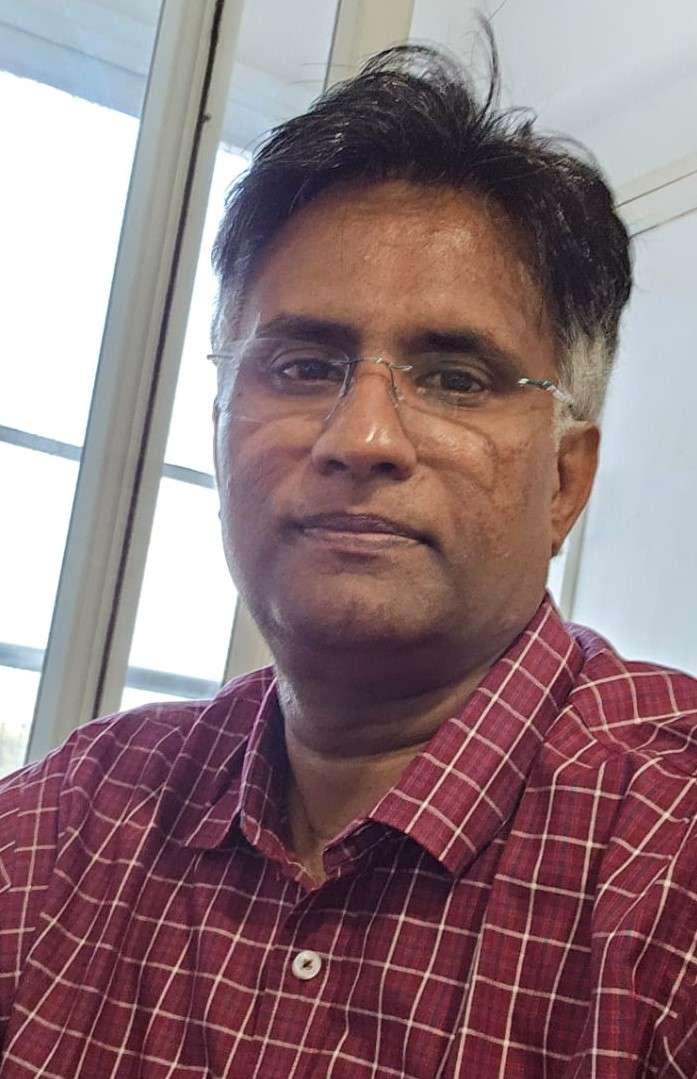

Ganesh Raj

Founder & Director

Global Maritime Review Consulting

Jayaraman Muthukumar

MD and CTOO

iWells Integrated Management Consultants

Mukundan V A

Delivery Manager

Tata Consultancy Services

Murugan P

Managing Director

Faradays Micro Technologies

Prabhu V

Partner

Dr. Lavanya Voice Culture

Raghunathan Nerur

VP Delivery

Quintessence Business Solutions & Services

Rajendran P R

Founder & Director

Nextwave Multimedia

Ravi Sankar

AVP

Sutherland Global

Sathish N

Head of Treasury Operations

Maersk Global Service Centers

h_corporates

Corporate Members

We collaborate with Corporates who wish to contribute to the future of innovation. Our Corporate members are strategic partners with a keen eye on startups that align with their unique vision and investment objectives. Beyond funding, they bring to the table a wealth of industry insights, acting as catalysts for exponential growth.

Let us achieve newer heights together

Services

For Campus Incubators

Startup Evaluation and Coaching: We collaborate with incubators to identify startups ready to raise funds for their go-to-market phase. After reviewing pitch decks, we shortlist promising startups and assess their progress, providing guidance as needed. Startups selected by our domain experts receive coaching on business plan preparation before being presented to our members for investor pitches.

Investor Pitch and Funding: When our members express interest in investing a meaningful amount, typically ₹50 lakh or more, we proceed with a thorough due diligence process. This includes negotiating shareholder agreements, executing necessary documentation, and transferring funds to support the startup’s growth.

Demo Days and Startup Events: We actively participate in demo days and other startup events organized by our partner incubators, helping startups gain visibility and connect with potential investors and industry stakeholders.

Mentorship and Support: We are available to mentor specific startups referred by incubators, offering tailored guidance to help them navigate their growth challenges and achieve their business goals.

For Entrepreneurs

Investment: We offer funding ranging up to ₹200 lakh to early-stage startups with high growth potential, providing the financial support needed to scale their operations and achieve their business goals.

Acceleration: We provide access to top-tier acceleration programs, including opportunities to enroll in programs at the Gopalakrishnan Deshpande Center for Innovation and Entrepreneurship and Stanford Seed. Participation in these programs is optional, allowing startups to choose the resources that best align with their needs.

Board Involvement and Strategic Support: For startups that secure funding, one of our investors assumes the role of Board Observer, working closely with the startup on strategy, business development, organization building, and the execution of growth plans.

For Members

Startup Evaluation: Members can evaluate promising startups and engage in detailed assessments conducted by domain experts. This includes in-depth reviews of product development and market opportunity evaluations, providing a comprehensive understanding of potential investments.

Mentoring Opportunities: Members have the opportunity to actively mentor startups, leveraging their expertise as industry leaders, successful entrepreneurs, and seasoned investors to guide and support emerging ventures.

Board Involvement: We offer a select member among the investors in a startup the opportunity to serve as a Board Observer. This role involves working closely with the startup on strategy, business development, organization building, and the execution of growth plans.

Knowledge Sharing: We periodically release a series of knowledge articles on various topics of interest to our members. These articles, along with regular newsletters, events, and webinars, provide valuable insights and updates from the startup ecosystem.

Exit Opportunities: We strive to facilitate gainful exits for our members by optimizing exit strategies during subsequent funding rounds, ensuring that their investments generate meaningful returns.

For Co-investors

Access to Validated Deals: We provide co-investors with access to startup deals that have undergone rigorous evaluation and validation by our team.

Micro Angel Investment Opportunities: Co-investors can engage in micro angel investment opportunities, allowing for smaller-scale investments alongside our primary funding.

Co-Investment Opportunities: Our network partners with a range of venture funds and accelerators to offer co-investors the chance to invest in early-stage startups that have been carefully selected by us. This collaboration enhances the investment opportunities available and supports startups through additional funding and resources

Join our Journey

Be a part of us and shape the future of startup’s landscape

Key Activities

Incubator Engagement

We collaborate closely with partner incubators to identify deep tech startups that have validated products and early customers, seeking go-to-market funding. These startups are rigorously evaluated to meet our investment criteria. Additionally, we participate in demo days, attend entrepreneurship events, and provide mentoring as needed, supporting startups at crucial growth stages.

Deal Sourcing & Evaluation

We source promising startups through partnerships with university incubators, accelerators, industry events, member referrals, and our network. Focusing on startups with validated products and early customers seeking go-to-market funding, our in-house experts rigorously evaluate each shortlisted startup, reviewing their progress, business model, and team. Startups that meet our criteria receive guidance on business plan preparation before being presented to our investors. This thorough process ensures we invest in startups with high growth potential.

Deal Making

Once meaningful investment interest is secured, we conduct thorough financial, tax, legal, and secretarial due diligence with our partners. During this phase, some members delve deeper into the startup’s business model and growth potential.

We simultaneously negotiate shareholder agreements to secure necessary rights, including affirmative vote rights and indemnities. Due diligence reports are presented to investors, with founders available for clarifications. We also appoint an investor as Board Observer to act as the SPOC for mentoring and monitoring.

Final steps include executing the Share Subscription and Shareholders Agreement and other allied documentation. All conditions are met before funds are transferred, ensuring a secure investment process.

Portfolio Management

We work closely with our portfolio companies through our nominated Board Observer to support their growth and success. Our involvement includes:

Strategic Guidance: Offering expert advice on business strategy and product development.

Team Development: Assisting in nurturing team members and finding talented resources to meet manpower needs.

Fundraising Support: Helping startups raise funds for future rounds by leveraging our extensive network and industry contacts.

Partnership Building: Facilitating connections with strategic investors and potential partners.

Our goal is to ensure that our portfolio companies reach their full potential and achieve their business objectives through dedicated support and valuable industry connections.

Exits

Our ultimate goal is to generate significant returns for our members through successful exits. We work closely with our portfolio companies to identify potential investors and negotiate favorable exit terms. Our team brings extensive experience in M&A and IPOs to ensure that our portfolio companies achieve the best possible outcome.

We encourage you to reach us !

Registered Office:

Corporate Office: